By Econ. Christian Takushi, Global Geopolitical Research, Switzerland, 27 Aug 2024 (This report was adapted and truncated for public release, 30 Aug 2024)

With USD 10 Trillion to finance, will Europe tap savings accounts?

Possible policy moves few are prepared for

(For our recent subscribers:

(a) We only release a report when our analysis significantly deviates from consensus or we shed light on something significant that markets overlook.

(b) We strive to write in a responsible, balanced and respectful manner, because it is too easy these days to raise fears and to project people’s anger against somebody else, a party or the government. There are enough people doing this – for commercial gain or popularity.)

Dear reader

Probably the biggest issue of our time – increasingly drives every other policy.

While current events are important and we do have an opinion on what unfolded last week in the United States (RFK Jr. endorsing Trump) and Israel at war, but also recently in the UK, France, Ukraine, Hungary, the Philippines etc. we are issuing a report on something else. Something no US presidential candidate or European leader is currently able to address, because they can’t stop a train that is speeding up.

I am talking about the fiscal deficit acceleration in the West, massive financing gaps and emergency measures that could soon be necessary. The three charts I have prepared reflect the magnitude of the funding crisis ahead.

Not addressing the large gap would only accelerates the bankruptcy of the European project or the inevitable takeover of the economy by the state.

Although as a trained macro economist I am committed to thorough objective analysis, please, let my analysis be just an external 2nd opinion. The issues at stake are not only daunting and complex (augmented by low data consistency), this is the current state of our analysis. We keep testing all our hypotheses.

A glimpse of what may lie ahead

Last week the three US presidential candidates were on stage talking about many things, except THE MAIN ISSUE. Did you notice what they didn’t talk about? The one thing that is increasingly driving everything else in the Western world and the 20 largest economies. If you understand this, much of the chaos may make sense.

No major platform is discussing the drastic accelerated deterioration of our public finances and, not surprisingly, few investors are prepared for what I think could be the biggest Policy Interventions or Wealth Transfer since the Great Financial Crisis (GFC) of 2008, and possibly WW2. Many will say this is bigger than the Covid response – except that it might be in reverse. While much remains unclear and factors could still change course, we are monitoring the growing likelihood of (or the early stages of) ..

- Europe increasingly eyeing private savings to finance NET ZERO (Costs of USD 40’000 Bn by 2050)

- Largest 20 economies (G20) coordinating efforts to tax their wealthy (a big wealth tax could be in the pipeline)

- Major unorthodox policy interventions might be necessary in the next few years

- Large scale crises and wars may linger as a result

I can say with a relatively high level of confidence that the combined side-effects of our collective behaviour over the past 50 years leave our policy makers no orthodox alternatives. Some people will of course argue that our EU leaders may have desired what lies ahead.

Growing importance of Geopolitical Asset Diversification – Since there is no such a thing as a risk-free economy in this complex transition the world has entered, it will come down to strategic diversification and the combination of 2 safe havens. At the minimum two complementary bases.

Forward looking investors have already shifted part of their cash and gold to less glamorous but geopolitically safe jurisdictions in the Southern hemisphere that have healthy fiscal-monetary policies and respect private property.

The twin-conditions are key: Highly indebted nations that still respect private property are already looking for ways to tap bank accounts and private savings to finance their deficits and large spending plans. Where prices have risen already too far or conditions no longer allow for corrections, governments have begun discussing socialising parts of the economy with their advisers. Those policy moves are likely to affect private property as we know it. We will not enter into the politics of this policy dilemmas and shall rather focus on helping people understand what could lie ahead.

The conclusions leave little room for pointing fingers

The issues at stake in this report could have been used already months and years ago to stir distrust and fear. In the social environment of the past four years it could have also been used for popularity and commercial gain. But we adhere to moral principles that lead to us to use our analysis responsibly. This is part of the reason why we have not released this analysis earlier.

At this stage of our ongoing independent analysis our conclusions on this highly complex issue point to a systemic phenomenon, where our governments are increasingly acting from a lack of options rather than from a preconceived hidden agenda. The geopolitical reality has caught up with European leaders and they are not in control as they used to be. This is especially the case of European states, that have maneuvered themselves into a major strategic trap. The growing competition between nations has reduced whatever control governments had over the course of their nations. As a result they are increasing controls wherever they can. Some leaders enjoy the limelight to give the impression they are running this world and they are under control. Don’t fall for it.

At my next key-note speech I will speak of “Ein fremdgesteuertes Europa” – In English it would be: Europe’s destiny now controlled by foreign powers.

I am not saying there aren’t officials and leaders out there that have such agendas, but the evidence of a systemic failure is more convincing and .. it is too simplistic to explain everything away with conspirative hidden agendas. Not that they don’t exist. But, such lines of thought shift all blame on some elites and leave us all conveniently as innocent victims. In our independent analysis .. most of us have somehow contributed to our Western predicament – actively or passively. Many of us have benefitted from the money printing and the excessive spending of our governments. Ultimately governments tend to reflect at least in part the societies they represent. When all educated decent people shy away from public office and only mock politicians, they cannot complain when governments are run by – what they call – scoundrels.

The inevitable Policy Shock would have been upon us in the late 2030’s, but it has been brought forward, because of the gigantic cost of our energy transition and the war in Ukraine.

Let’s recap: So far our independent analysis points to practically unavoidable far reaching fiscal-monetary policy steps (that may soon be upon us) – An inevitable result of our collective consumption rush, debt appetite and recession-aversion over many years. Many of us have been recipients of handouts and benefits – all financed irresponsibly. In the policy framework of our Western societies concerned policy makers have had no other choice but to kick the can down the road. Neither consumers nor retirees wanted the government to stop over-spending.

Not an activist

I am not a EU-skeptic that uses analysis to prophesy the downfall of the EU – In fact I am only driven by forward-looking analysis and this points to a security & financial collapse (reset), that is very likely to be followed by a much swifter European Integration Process.

Before we look at any set of numbers, let’s get an idea of the big picture first. Numbers without context can be misleading or misused for anything.

The West in a fiscal-monetary trap – But Europe is alone

After 49 years of non-stop stimulus, most of our Western economies are artificially inflated. The prices of our houses, stocks, bonds etc. are all inflated. But it is no easy thing to deflate such a giant bubble across major Western economies. No one has ever done it – and so far all Western economies tried to manage this in tandem. But Europe’s big self-made problems are too big to be overseen. Understandably other world powers are taking swift advantage of Europe’s predicament: If Europe de-industrialises first or is forced to reset first, all other powers can hope for a more controlled transition.

On the surface all major Western economies are highly indebted and facing a fiscal deficit & debt crisis. And not surprisingly also a moral crisis. But while America has the benefit of the USD, other Western states can no longer print money at the rate that Washington does. If they do, they risk a system destabilisation. Europe’s big errors have handed America a big advantage in this geopolitical-monetary transition.

While America can inflate its way out of every crisis – as the inflationary shock, currency debasing and funding is spread globally, Europe can’t print paper-money endlessly without visible “real” pain (productivity decline, inflation, youth unemployment, impoverishment, de-industrialisation, lack of organic growth etc.) and seeing less demand for its currency and debt amongst non-Western economies. Thus, our governments are going to have to force domestic institutional investors to buy more of our overrated debt or highly subsidised projects. And find new sources. If this fails, policy makers may opt for resetting events – of which there is no lack thereof.

In the past we (Europe) had a monetary disadvantage versus America, now we have a massive disadvantage on the monetary, energy, military, technology and security fronts.

Keep this geopolitical big picture in mind as we move forward.

Why Foreigners won’t finance our deficits & capital commitments

Very simply, America is rapidly outgrowing Europe thanks to a massive “Invest in America” push by both parties .. and the healthy fast growing economies of the world have grown distrustful of Europe’s security predicament, loss of sovereignty and declining economy.

As the old saying about the “frog in the hot water” implies: One has to literally live in Europe and enjoy state-owned TV to be able not to see how difficult our predicament is.

Sadly, just as we warned in Summer 2022, our combined policy actions of recent years have pushed the healthiest economies in the world into the arms of China and the BRICS. The BRICS economies might be healthier than the West’s but they are not the healthiest!

All of the above matters to us, because given our stagnating economy and the gigantic increase in our capital needs (NET ZERO alone is expected to costs us USD 40’000 over 25 years), the marginal investor will set the price of our capital raising going forward. For social stability we will have to pray that the rising temperatures in our time were all indeed caused by our CO2 emissions and nothing else.

If we also want to “rig” the cost of that capital, Europe risks becoming de facto a centrally-planned impoverished economy. The savings of Europeans would earn suboptimal inflation-adjusted yields to help lower the cost of our Energy Transition. But have you seen how even our massive subsidies, state investments and price arrangements could not keep energy producers, wind turbine makers or solar panel makers from bankruptcy risk?

After discussing Chart 3 I will also explain why the European Private Economy won’t be able shoulder much of the cost of EU’s investment plans.

Rest of the world’s interest in Europe sinks ..

Although our Western media portrays the globe as if the whole world is suffocating in debt and fiscal deficits (highlighting Venezuela, Bangladesh or Pakistan in the news), many emerging economies have rebuilt their economies since the 1990s on much healthier fiscal-monetary foundations than the West.

The growing emerging economies with sustainable monetary policies have decided to reduce their exposure to our debased paper money and mis-priced debt. Thus, while they can’t afford to be without the USD for their cashflow and asset & liability management, they are trying to reduce exposure to the troubled European continent and hence the EURO. They will not only attract more capital, they want to buy less of our bonds and assets.

Sadly, Europe is attracting mostly foreign investors with selfish geopolitical interests and I doubt our political and business leaders have the geopolitical literacy to navigate that.

Little reaction

Twice over the past 12 months EU finance ministers reportedly talked about tapping or mobilising the private savings and pensions of European citizens to help fund the huge energy and military investments, but very few people paid any attention. The few reactions were on two extremes: condescending stance or outright fear of confiscation.

Americans have asked me how is it that Europeans are so indifferent about the state eyeing their savings as a source of money? The answer may be linked to the fact that a large number of us in West Europe get our news from state-owned TV.

For ten years we have been monitoring the talks amongst senior finance officials of European nations about the expected increase in public spending and the stagnating tax revenues of a troubled EU economy. They know it will not get better. If you actually exclude the effect from the EU expansions and state-enforced capex, our over-regulated organic EU economy has been shrinking.

Figures speak for themselves

On the one hand the jungle of EU fiscal data is overwhelming – On the other hand the accuracy of projections is limited in a European Union where sovereign states at times rival the EU Commission.

There are some figures though that will help you understand why concerned finance officials have been talking about this issue on and off for years and why it is also in no one’s great interest to talk openly about it. Only crises bring the necessary pressure to move the integration process forward.

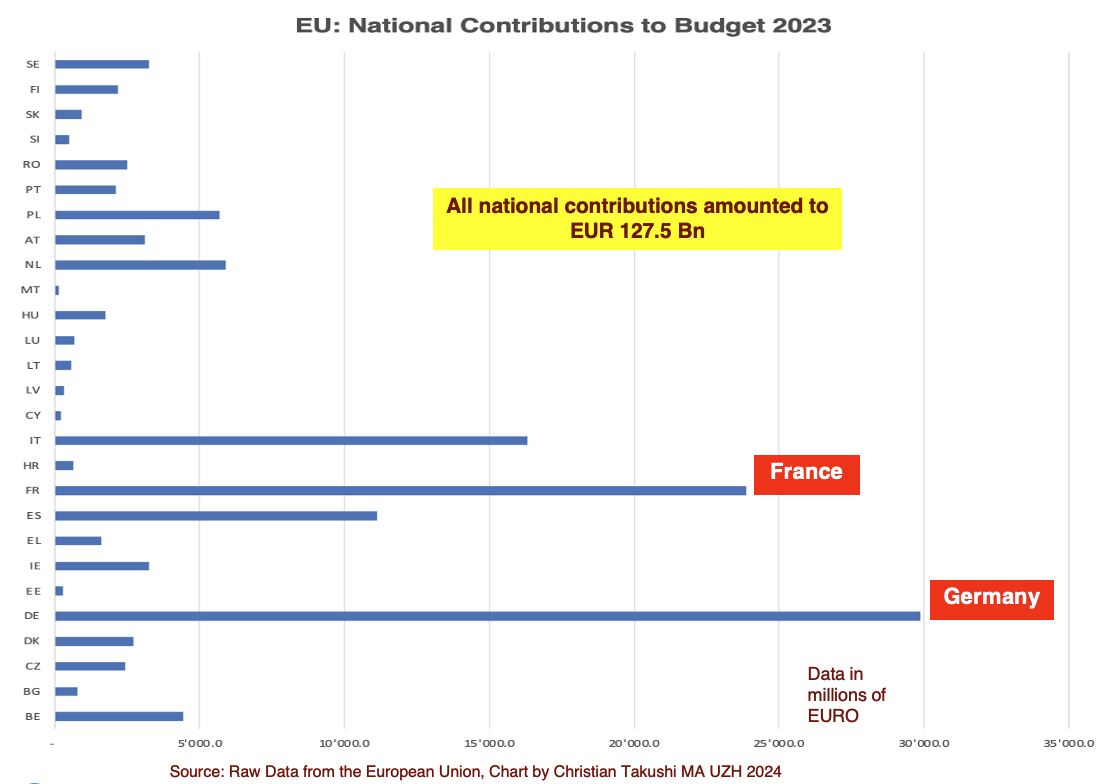

The table below shows the size of the financial contributions of each EU member country to the EU budget. Accounting-wise these contributions represent the revenues of EU. All contributions amounted to some USD 140 Bn last year.

Chart 1)

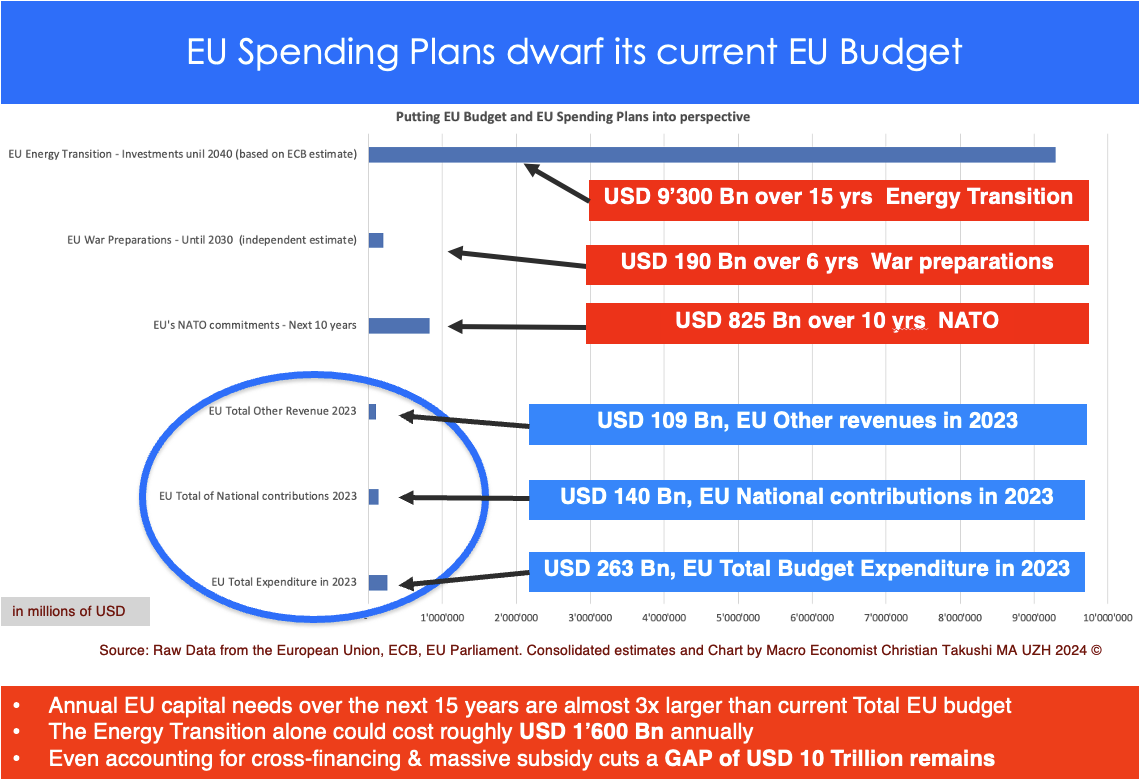

The EU budget is not small, but it is dwarfed by the Expenditure Plans of the EU for the next 15 years. I have focused here on energy and security, leaving other spending plans aside, because these two will shape the political process .

In our most conservative model the EU capital needs will be roughly 3x larger than its current budget – every year until 2040. The situation between 2041 and 2050 will be even more precarious. According to a less optimistic model the spending plans of the EU could be 5x larger than its current budget.

The financing shortfall is large. Where will the money come from?

A glance at our next chart may explain why many experts avoid putting these figures in one chart. In part, because many EU officials think the government will only have to bear part of the cost. They say there are multiple sources of money and eager investors that are committed to fighting Climate Change and rebuilding our military. But looking at each one of those sources, I see am less confident. No matter how many simulations one runs to find the money, realistically speaking the EU is opening a giant financing gap – just at a time when other sources of capital are shunning away from Europe.

Mrs Christine Lagarde has acknowledged that the EU needs to invest EUR 800 Bn per year in the next decade to stay on track for NET ZERO by 2050 – that makes USD 8’800 Bn during 2031-2040. Based on several EU investment plans our estimate of USD 9’296 Bn over the next 15 years for the Energy Transition is thus not unrealistic. Some may even say it is not high enough.

I am not saying we can’t find the capital to finance our big commitments, but I want my readers to see the size of our current EU budget vis-à-vis the size of the planned investments for energy and military security for the next 10 to 15 years.

Key EU states have also begun war preparations – my current independent estimate for these investments runs at USD 190 Bn over the reminder of this decade on top of NATO recurring commitments. And this estimate is rising in recent months as EU officials discover the heavy industry to build the needed equipment is derelict and more realistic military exercises are laying bare the 25 years of dismantling of our Armed Forces. Much of what we think we have, exists only on paper and heavy-weight supply lines from West to East often do not even exist. Security has been taken for granted by EU leaders and citizens alike. A damning testimony to our geopolitical illiteracy.

Chart 2)

Even after creative budget exercises, massive subsidy cuts (which would reignite inflation) and cross-financing a big financing shortfall remains. Interestingly, we observed that when faced with the massive capital needs, European finance officials have talked about the idleness of Europeans’ private bank accounts – in fact the only pool of money left that is big enough to effectively help finance the gigantic EU investment plans: We are talking about USD 11’400 Bn in liquid assets.

Why I think the Fiscal Deficit and Financing Gap is a crucial issue for Western states and especially Europe? Our main sources for additional fiscal spending in recent years were either unsustainable or unsustainable-inflationary-immoral.

But how can Europe tap the bank accounts and eventually the pensions of its citizens? This is where the European Capital Market Union comes into play.

Brussels wants to merge the financial markets of individual states on our continent to facilitate cross-border investments. This should help finance the big spending plans of the EU. A mix of regulations, guidance, incentives, subsidies and prohibitions should mobilise private firms and also allow savers to mobilise their money voluntarily ..

This report has been adapted and truncated here. To request a subscription to our newsletter you can write to info@geopoliticalresearch.com stating your name and country of residence.

Other sections in the original our report

- Paradigm Change starts in 2021

- America reigns

- EU eyes one major source of capital

- Tapping of private savings – Part of a reset?

- What Brussels overlooks: The private economy is not private (anymore)

- Europe’s Safe Haven is no longer enough – Geopolitical asset diversification

Important note:

This report reflects the current state of our research and it could change if more accurate figures are available, estimates change, policy goals are adapted or the global conditions change.

All analysis, conclusions and charts were made wherever possible using data and estimates from EU institutions. Adjustments were made to make the assessment as realistic as possible. In particular we think the EU is overestimating the ability of the private sector to shoulder the costs.

By Christian Takushi, Economist, Global Geopolitical Research, Switzerland, 27 Aug 2024 (This report was adapted and truncated for public release, 30 Aug 2024)

Geopolitical Research Team – Tue 27 Aug 2024

Research made in Switzerland

Geopolitical and economic conditions need close monitoring, because they can change suddenly.

No part of this analysis should be taken or construed as an investment recommendation.

For subscriptions or comments write to info@geopoliticalresearch.com

Since 2016 our newsletter is ranked among the 50 most reliable sources of geopolitical analysis worldwide.