By Christian Takushi, Macro Economist. Switzerland – 18 Dec 2023 (public truncated release 21 Dec 2023)

This is a somewhat unusual but important update. No change in our assessment and no change in our outlook. Rather a call for alertness.

Many of you are responsible for investment strategy, asset allocation or your own family investments.

In recent weeks the stock market has been rising to new highs powered by falling inflation and the firm expectation that the FED will significantly cut rates in the coming months.

I agree that inflation (YoY) is coming down due to the statistical basis effect and an inherently weak economy – Yes, underneath the massive deficit spending by our governments and artificial GDP growth per decree, our debt-driven economy is weakening. Markets are behaving as if all that matters is inflation, the FED has to cut rates massively and geopolitical threats will disappear. They are actually intensifying.

The problem is financial markets are solely reflecting excess liquidity in the system. Nothing else! Where is the financial media? Where is the oversight duty of markets and bond vigilantes? Are bond yields driven only by temporary inflation and not deficit sustainability? The truth is all major stakeholders are sitting in the same boat and letting our policy makers control our inflated market prices – collusion in silence?

This is absolutely remarkable – knowing that we are in an economy full of unprecedented bubbles, rather than being cautious, investors are ecstatic about the loose financial conditions and buying risk assets.

I even ask the question “is it really wise to buy inflated risk assets simply, because everybody else is buying?” It is not the case that there are no alternatives. Oh yes, momentum investing rules! I am not per se critical about stocks – I see cheap stocks for instance in Brazil and even Greece, but not in the Nasdaq or US blue chips.

Looking at the big picture: investors are not pricing these developments ..

- Geopolitical forces continue to overlap and could usher renewed disruptions, shocks and bouts of inflation in 2024 – Markets are celebrating “inflation is defeated”, but they are in a kind of illusion: Consumers are paying 30% to 40% higher prices than three years ago!

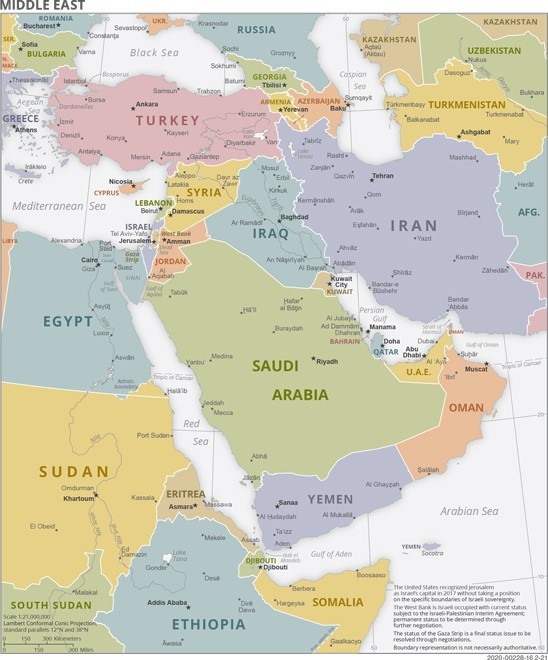

- As we have warned earlier this year countries and groups allied with China and Russia will block the Suez Canal and keep up the threat to repeat it as geopolitical deterrent to influence EU Foreign Policy

- Shipping costs and insurance costs are rising

-

Energy costs are bound to rise again

..

This report has been truncated here. If you wish to read the full report of subscribe to our newsletter, you can write to info@geopoliticalresearch.com

By Christian Takushi MA UZH, Independent Macro Economist and Geopolitical Strategist. Switzerland – Mon 18 Dec 2023. (Public truncated release on 21 Dec 2023)

Research made in Switzerland

Geopolitical and economic conditions need close monitoring, because they can change suddenly.

No part of this analysis should be taken or construed as an investment recommendation.

For subscriptions, comments or donations write to info@geopoliticalresearch.com

Since 2016 our newsletter is ranked among the 50 most reliable sources of geopolitical analysis worldwide.

Independent research and releasing a report only when we deviate from consensus adds value.

By Christian Takushi MA UZH, Independent Macro Economist and Geopolitical Strategist. Switzerland – 1 Dec 2023.

Research made in Switzerland

Geopolitical and economic conditions need close monitoring, because they can change suddenly.

No part of this analysis should be taken or construed as an investment recommendation.