By Christian Takushi, Macro Economist, Switzerland – 17 April 2023 (delayed & truncated public release on 25 Apr 2023)

(G7, BRICS, EMERGING MARKETS DECOUPLE FROM USD, MASSIVE SHOCK TO G7 RISK ASSETS COMING, ECONOMIC CONSEQUENCES, RESET, WAR, AMERICA IS NOT OUT YET)

The clash between the West and the Global East & South that has been simmering for months and that we said would erupt before the BRICS Summit in August 2023 has now come to the surface in full view of a global audience. The economic hostilities have gone global: A “war” has been declared on the USD. An unprecedented number of nations has declared in recent days they want to decouple from the USD monopoly and our Western financial dominance. Washington is likely to fight back subtly and ruthlessly.

As usual Western financial markets haven’t priced any of these developments, because since 2009 markets are driven mostly by excess liquidity. Economic fundamentals are only short term drivers. But this time, a major external factor outside of the G7’s control is rising and markets could be ravaged later this year or 2024. Just as they were in 2022 or worse.

Year of confusion at markets

As we mentioned last December economic data in 2023 would be highly contradictory and it has already caused much confusion and losses. The yield curve inverted and pointed to a sharp recession, while equity markets and other risk assets rallied discounting rate cuts. After 14 years of government interference with asset prices and interest rates, economic data is distorted and no longer reflecting economic realities in 2023. We remain cautious with pure data signals for the time being.

Why we should not focus on markets too much at the moment

Keep an eye on the big picture. There are several things happening at central banks and finance ministries of from Washington to Tokyo unsettling financial markets. A number of markets are under stress, with commercial real estate being the biggest concern for policy makers, but a much bigger storm is brewing. Since commercial real estate can be seen as an internal problem policy makers can influence, this “storm” is a much bigger threat to financial stability, because it is driven by the BRICS and a group of emerging and developing markets. It can therefore be seen as an external factor outside of the West’s direct control.

Our markets to run until disrupted from without

Many are predicting the imminent collapse of our financial system since 2010, but get it wrong. I believe one of the main reasons for that is the following: The collapse or implosion of the Western financial system with its inflated asset prices and gigantic debt bubbles will unlikely come from within (as all stakeholders from policy makers, investors .. to media and retirees sit in the same boat and cannot afford to trigger the correction of their artificially inflated wealth), but rather from the outside. After our markets rescinded their fiscal and monetary oversight roles in 2010, only an external factor outside our Western control is likely to trigger the busting of our bubbles.

Is the external challenge we fear finally here? The non-Western world is rallying around the BRICS and the West is bracing itself for the BRICS Summit in August. Something is likely to happen in the coming months.

The BRICS have learnt a bitter lesson – They flagged too early their intentions and were almost wiped out by Washington moves in recent years. BRICS are now sending multiple signals, but not revealing their ultimate plan to unseat the USD and the Western monopoly on the financial system.

We have a global system in which de facto every company or nation that wants to do business internationally has to use the USD. When nations buy food for their citizens, they use the USD. As the USA consolidated its power through the G7 and later G10 during the Cold War, the G7 currencies became auxiliary currencies to the USD, making the G7 economies de facto beneficiaries of the Petrodollar system – This means that Europeans also get to print money excessively, grow on debt, live beyond their means and have their share of – what a famous US investor has deemed – “pretentious expenditures”.

For decades the rest of the world has had to accept the “debased” USD, EURO, Pound Sterling and Yen for payment. They say they’ve had enough of our currency dominance. But are they making a mistake by announcing their revolt without having made their new settlement platforms fully operational?

Some say the collapse of the USD is imminent, the Western financial press says it is decades away (which may not be an unbiased view), but the truth may lie in the middle. While the fall of the USD may still be months or years away, the war over the USD monopoly has begun. It will affect many businesses, portfolios and many lives.

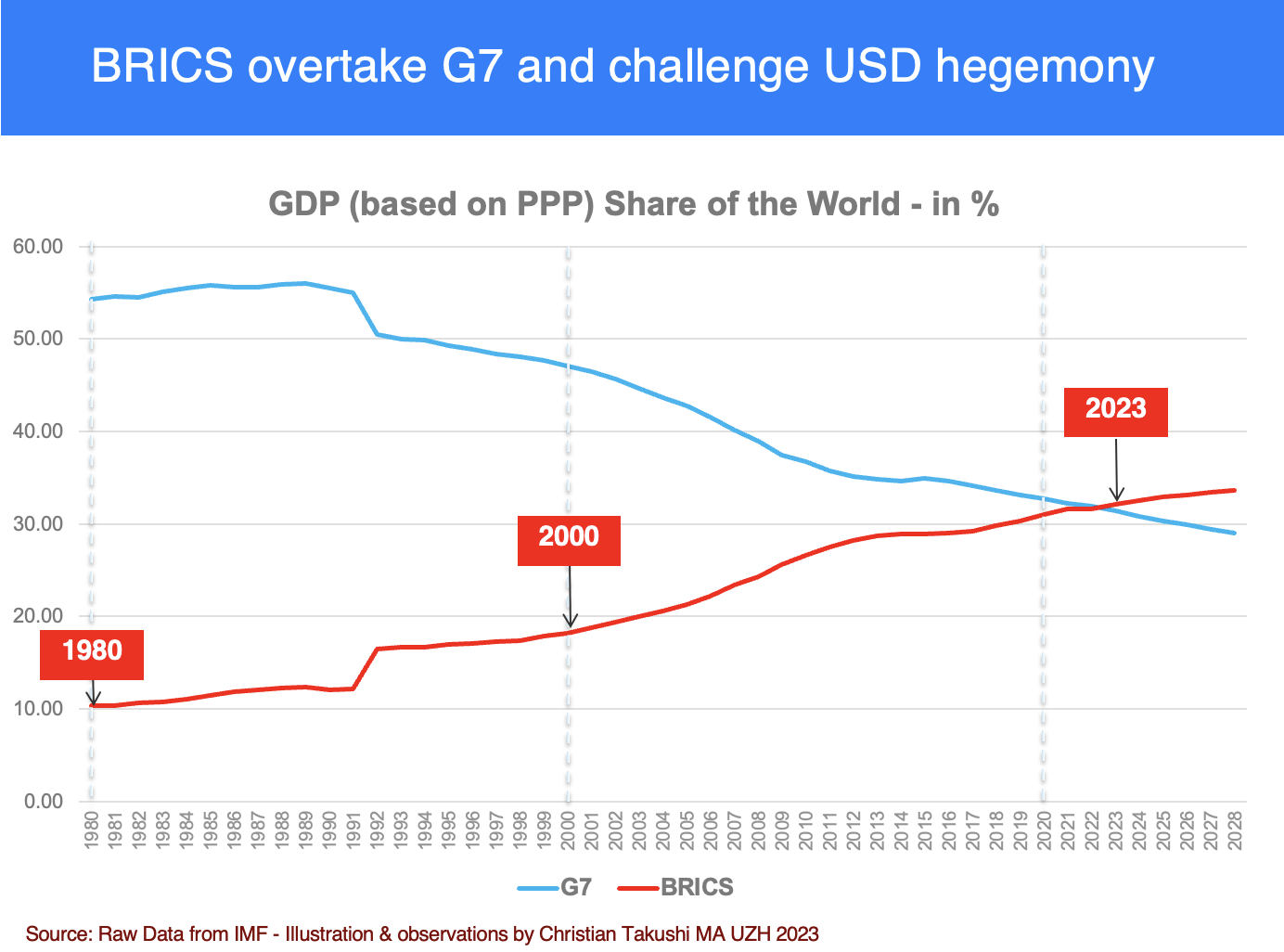

The BRICS overtake the G7 in their share of World GDP

Due to the many crises our world faces few people noticed that finally the BRICS have overtaken the G7 leading industrialized nations in their share of World GDP (PPP based). The fact that Brazil-Russia-India-China-South Africa have overtaken the powerful G7 (USA, Japan, Germany, Japan, UK, France, Italy and Canada) puts the current war in a wider economic perspective. The balance of economic power is shifting. Military power is also likely to shift in due course.

The surge of China-Russia-India-Brazil-South Africa is absolutely stunning. In the year 2000 these five BRICS nations had a mere 18% of World GDP compared to 47% of the G7 (the seven richest nations). This year the BRICS reach 32.1% vs 31.4% of the G7 (all PPP based).

The Purchasing Power Parity based GDP is the more preferred measure amongst economists to compare the economic output and well being between nations.

The non-Western World defies the West and the USD

Over the past 12 months Washington and Brussels have concentrated their energy on isolating Russia and decoupling from China. Sanctions were threatened on nations and individuals that dared to deviate. Nations were asked to restrict vital exports to China. As sanctions were circumvented by many nations, Washington and Brussels have been announcing their latest round of sanctions against those helping Russia.

The world is responding: In recent days key nations like Saudi Arabia, Brazil and even France are daring to challenge Washington and have shown the isolation strategy has failed. Sensing Washington’s growing vulnerability, they are not afraid to distance themselves from Washington and to challenge the USD

- Brazil follows India and Saudi Arabia in breaking the “Russia isolation & China decoupling” that the West has advanced after the invasion of Ukraine – In the harshest criticism at the West yet President Lula said:- Washington is promoting the war in Ukraine

– It is time for the USA and EU to embrace peace

– It is time (for the world) to decouple from the USD

This comes just days after ..

- Saudi Arabia settles an important energy transaction in Yuan

- India has openly increased purchases of Russian Oil – settling ex USD

- Indonesia reaffirms it wants to join the BRICS and trade without the USD – the powerful ASEAN nations Malaysia, Singapore, Thailand & Philippines also agree to decouple from USD

- Mexico says Washington no longer has any moral standing to lecture it – Mexico has requested membership in the BRICS

- France says it doesn’t want to be dragged into Washington’s wars in Asia. France doesn’t want to decouple from China, only de-risk

The most articulated criticism comes from the powerful group of South East Asian nations (ASEAN). In a nutshell they say: the Western currencies and central banks have become a major source of systemic threats that don’t reflect the way their economies and other world regions have evolved. They emanate from Western excesses.

Twelve months after the start of the war in Ukraine, the weaponization of the USD (the seizure of a nation’s foreign exchange reserves) by the G7 and their threats of sanctions aimed at other nations, the response of the rest of the world is furious.

What tipped the balance? Roughly 70% of non-Western nations say they disagreed with the Western narrative of the war in Ukraine, but they accepted most of the G7 sanctions against Russia. Except for two things: The seizing of the foreign exchange reserves of another country and the simultaneous threats against them (to face the same if they would not follow suit) shook them to the core and took away the little trust they still had in the West. They say, “the G7 has crossed an unprecedented threshold – The G7, IMF and World Bank led them to use USD, EUR, Pound & YEN and to put their foreign exchange reserves in those currencies, now the West wants to use sanctions to seize their savings. The West talks about a rules-based order, but the G7 break the rules at will (some leaders mention the Panama invasion and Kosovo, others mention the 2nd Iraq war and subsequent US threats against the ICC etc.)”.

Food for thought – With one stroke the West has galvanised the resolve of the rest of the world against itself. With the German and British economic growth faring no better than Russia’s, but the rest of the world turned against the West, it seems the USD weaponization is backfiring. The sad thing is barely any of our leaders is fully aware of this worrisome trend. Only two weeks ago US media broke the news about the dangerous isolation of Washington around the world, because Mr. L. Summers said it. Eleven months late. We should have engaged with Asian, African and Latin American leaders long ago to hear their concerns and explain our moves and deviation from the rules – We didn’t. Our leaders say they know that Oriental and Southern powers are rising, but they are not reading analysis nor research from those capitals. Our politicians and investors still read the same newspapers as in the days when the combined West (all developed nations) made up 80% of the world economy. Our share of the world economy is down to just 41% and declining. Still, all we read is our own opinion – as if Oriental and Southern powers would deal with us on our terms. They study and read us, we still refuse to study and read them. Is it pride? Probably yes. But also the wealth illusion that our fiscal-monetary policies have fed over more than four decades. We still think we are doing OK, because our policy makers are artificially inflating our house prices, bond prices, stock prices and discretionary consumption. In fact it is a gigantic bubble. When the bubble bursts, the share of the West in the world economy will fall sharply. The reason why we cautioned last year about using the USD as a weapon was that our G7 economies are full of asset bubbles. These bubbles make the West vulnerable to how the rest of world uses the USD.

The future of the West looks uncertain, because 2/3% of humanity wants to decouple from the West or at least to reduce its dependency on us. Much of the West’s standard of living has depended on the whole world accepting the Bretton Woods system that the USA asked the allies to adopt at the end of WW2. That system gave the USD superpower currency status and later led to the US-Saudi security-oil deal that practically forced all nations to buy Saudi Oil in USD and to trade commodities in USD. Europe benefitted from this by extension. Now the rest of the world is rejecting our Western monopoly on the global financial system. If they see it through, our sanctions would have brutally backfired, because the deficit- & debt-driven lifestyle of Western Europe and USA would implode. With it our bubbles.

If Emerging Market succeed to reduce the use of the USD and EURO by more than 1/3, there is only one exit for our policy makers to avert a correction in asset prices over 50%: it is to seize control of aggregate demand, supply & asset prices and/or launch a total reset. The formerly capitalistic G7 economies are already gradually becoming state-run economies. Western investors looking for capitalistic free market economies would have to go to Asia, South East Asia or Latin America (exodus). Therefore I expect Washington to target key Emerging Markets in the coming months and to deploy the full range of US/Western options – subtly first, but possibly harshly later. While I think Brasilia, New Delhi and Jakarta underestimate the power and resolve of the Biden Administration, those nations are not as naive as they were in 2022, when Washington choke them with the fastest rise in interest rates ever, a strong USD and rising commodity prices. I think the USD will not go down as fast as the BRICS wish, but the hostilities that will follow in the near future will affect the world economy. Have markets prepared for that? Not at all – all markets care since 2009 is excess liquidity provided by the FED – and they have not fared badly with that so far. In our dysfunctional Western economies, our stock and bond markets are mostly detached from economic reality, stock prices follow “excess” liquidity or the size of our central banks’ balance sheets.

There are three nations that will greatly influence the outcome of the West-East conflict and regardless of when the USD falls, the actions that will be taken in the coming months by the 29 nations defying the West and the likely preemptive moves (strikes) by the West will impact currencies, safe havens and financial markets. The specific role of these three nations is likely to shape Washington’s policies directed at them. Europe has often underestimated America: Nations like Britain, Germany or France are re-learning the bitter truth that nations have no permanent friends, only permanent interests. As Washington fights for its survival, powerful leaders in the US Senate and House of Representatives are increasingly advancing policies and preemptive moves that allow America to survive at the expense of the EU and UK. All nations advance their national interests with all means at their disposal – that is the essence of geopolitics. Thus, if Europe falls, no one here can blame it on Washington. Not only did we fail to defend ourselves, the same leaders and advisers that dismantled our military and got us here, have been chosen to shape our policies. Thus, Europe has to “own” the outcome of this decade.

We have simulated how a partial de-coupling away from the USD to a set of currencies and gold would affect the path of the G7 and BRICS economies after 2024 (See the next chart). There could be roughly a 9% decline in the expected G7-share of world GDP and a 5% increase in the BRICS share in the world GDP following the adjustment. Our bubbles would begin to implode as our ability to export our deficits and printing money is reduced. China would benefit somewhat less than what it thinks, with a number of Emerging Economies that are running even healthier fiscal-monetary policies than the BRICS take up big benefits.

Emerging Markets: the West is disrupting our rise, conflict unavoidable

The Developing World overtook the Developed World already in 2008 in their share of World GDP (PPP). Since then

This report has been truncated here for the public. If you wish to read the full report and subscribe, you can write to info@geopoliticalresearch.com

Global Geopolitical Macroeconomic Research – Helping decision makers prepare for and react to Risk Events

By Christian Takushi MA UZH, Independent Macro Economist and Geopolitical Strategist. Switzerland – 17 April 2023. (Public release on 25 April 2023 truncated, adapted and delayed)

Geopolitical and economic conditions need close monitoring, because they can change suddenly.

No part of this analysis should be taken or construed as an investment recommendation.

Honouring the men that fought at Midway – Their bravery should be remembered

To subscribe you can write to info@geopoliticalresearch.com

Since 2016 our newsletter is ranked among the 50 most reliable sources of geopolitical analysis worldwide.

Independent research and releasing a report only when we deviate from consensus adds value.